How to send invoices to customers in Austria, Switzerland or the EU.

How do I send an invoice to foreign customers?

You probably want to send an invoice to foreign customers as well. However, there are a few things you need to consider. Austria and Switzerland may have different accounting requirements than Germany. In the EU at home and abroad it can be a bit different, not just in terms of the language.

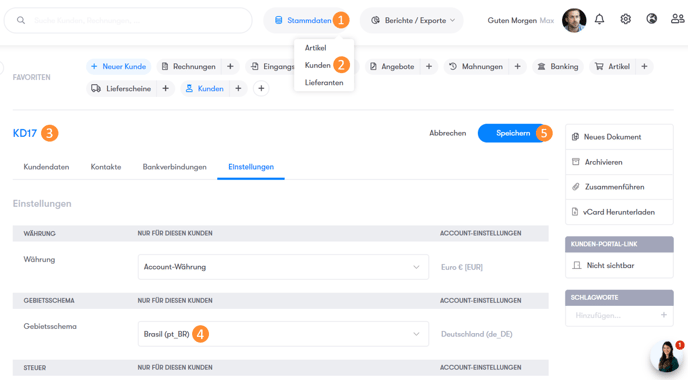

Where can I set the language or the locale for the customer?

If you select a customer (2) in the customer overview (1), you can select the necessary options for language, locale, etc. in the Settings tab (3). For example, we selected the Brazil locale (4) and clicked Save (5).

How can I adjust the language on the invoice template?

Basically, the standard template changes to the correct language, depending on which one you have set individually for your customer.

Example:

If you have selected Brazil in the locale for a customer (as we explained above), the language of the default template of your invoice will change to Portuguese.

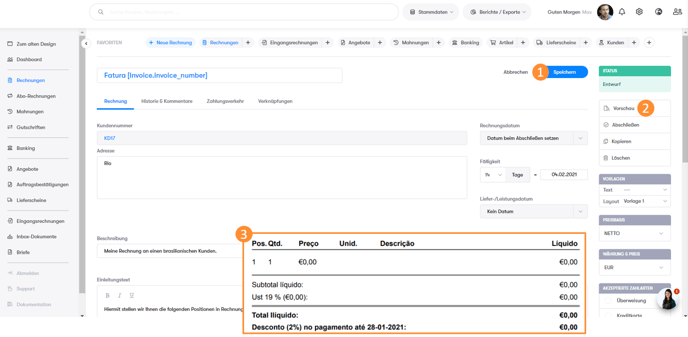

Let's say you've created your Brazilian customer and created a new invoice for that customer. Now click on 1) Save. Then a menu appears on the right-hand side in which you 2) select Preview. Your Portuguese invoice will now open automatically and the content has been linguistically adapted as in 3).

How can I adjust taxes in my invoices?

Not only does the language often change with foreign customers, taxes are also often affected by special regulations.

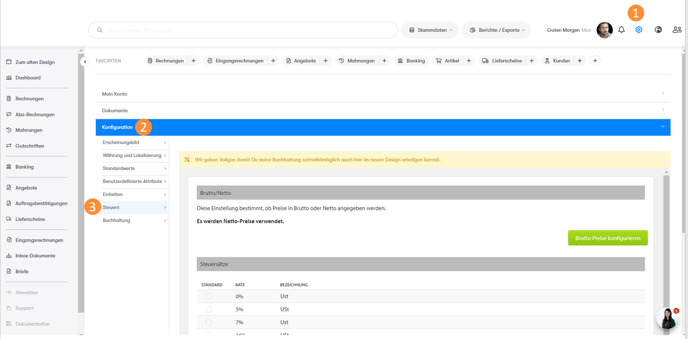

Navigate to: Settings > Configuration > Control

In addition to your tax rates, you can also specify which countries do not have to pay tax . This is of particular interest in the reverse charge process. The tax burden is not borne by the entrepreneur providing the service, but rather by the recipient of the service abroad.

There is then no sales tax to be shown on the invoice, only the net amount, a reference to the reverse charge procedure (see also summary report) and the VAT number of you and the recipient.

Write an invoice to foreign customers using your own template

If you are not using the standard template, but your own, you can set up a template for every eventuality. So if it is foreseeable that you are serving English and French customers, you can upload your template in duplicate. When you complete an invoice, all you have to do is select the correct template with the correct language.

Tip: Here we explained how to create your own template.

Use custom attributes

Custom attributes can do a lot of work for you in special cases. Let's stay with the example of the reverse charge procedure. Instead of pulling a text for the reverse charge procedure from your fingers for every invoice for a specific customer, you can create a custom attribute once.

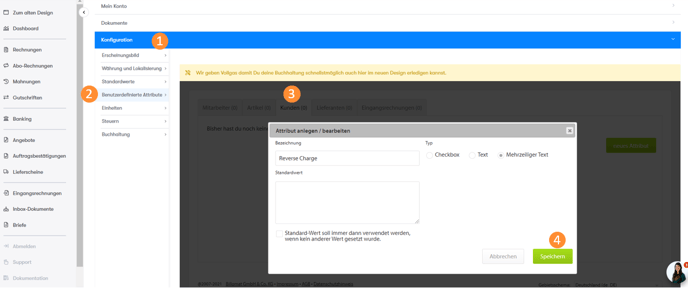

Navigate to: Settings > Configuration > Custom Attributes

For our example we create a customer attribute. We choose "multiline text" and call it "Reverse Charge".

In the details of each customer you can now access it via the Customer Attributes tab. For customers who use the reverse charge procedure, enter your desired text in the note:

"Tax liability of the service recipient" or "Reverse Charge"

After we have entered the relevant information for all necessary customers, we go back to

Settings > Configuration > Custom Attributes.

Here we find the placeholder for our attribute in the format [Client.propertyXXXX]. You then simply copy this placeholder into your comment.

The effect?

The reverse charge procedure appears here for all customers for whom you have filled out the text field. If you have not entered anything for a customer, the placeholder remains empty; nothing happens. So you can also automate the reverse charge process halfway.