You are currently using the Billomat banking interface and want to continue using it? Then here you will find the instructions on what to do now.

I. Most important information

II. What to do?

1. connect to the bank

2. select account

3. deposit and confirm banking credentials

4. final steps

I. Most important information

As of 08/31/2023, the current banking interface will be deactivated. To use the new banking interface, follow the instructions under point II. What to do?

Of course, all your previous transactions will be transferred to the new banking. The exact time of the data migration in your account, you will find out in our update mailing.

Important:

- During migration, your complete transaction history, i.e. from the beginning of your Billomat banking setup to the day of the last synchronization, will be migrated to the new banking module.

- To ensure a complete history, we recommend synchronizing your banking data in the old banking at least once before the migration.

- During the initial synchronization of the transactions in the new banking module, the transactions are loaded from the day of the last synchronization to the day of the new connection.

- We recommend that you connect your accounts in the new banking module on the day of migration.

- An algorithm will match the data in the new banking with the previous data in the old banking. Nevertheless, please note: especially at the beginning you should pay attention to "duplicate transactions". You can either mark such transactions as "done" in the new banking or hide them.

II. What to do?

1. connect to the bank.

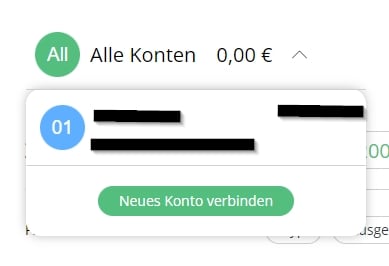

Navigate to "Banking" in the left menu bar, select the desired account from the "All accounts" drop-down menu on the left and then connect by clicking "Connect new account".

2. select account.

In the next window, enter the bank details of the account: Select the bank you use from the drop-down menu or enter the IBAN, the sort code or the name of the bank directly into the field

3. Enter and confirm banking access data.

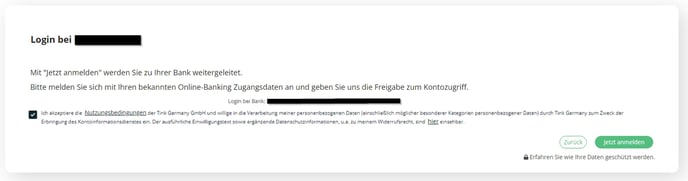

As soon as you have made a selection and confirmed it, you can enter the access data for your bank account in the next step.

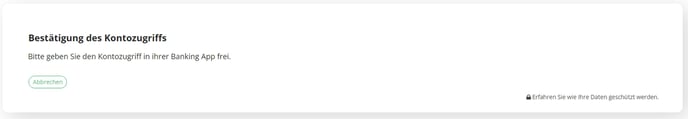

After you have accepted our partner's user agreement and clicked on "Next", you will be asked to approve access to your bank account via Billomat.

Depending on the bank you use, the following step may be different. For example, you may be redirected directly to your bank or you will receive a request to authorize access via a mobile app of your bank (e.g. via TAN procedure).

4. final steps.

If the authorization of your credentials was successful, you will be redirected to the list of your transactions and, as mentioned above, the most recent transactions will be uploaded to Billomat. Depending on the number of transactions, this process may take a few minutes.

The transactions will be loaded in the background, so you can devote yourself to other tasks in the meantime.

As soon as the process is completed, you can assign the transactions to your invoices or process your payments.

III. general information

Which banks can I connect to Billomat?

Billomat Banking supports almost all banks in Germany and Austria. Numerous banks from abroad are also in our network. Feel free to contact us, we will check afterwards if your bank is supported by the interface

How does the automatic assignment of transactions to invoices work in the new banking module?

Currently there is no automated assignment of transactions to invoices in the new banking module. This function will be fundamentally revised and modernized so that automatic posting can be handled even more intelligently in the future.