Here we explain what an e-invoice is and how you can create e-invoices in the correct format (XRechnung and ZUGFerd) in Billomat.

What is XRechnung?

XRechnung is the standard for electronic invoicing for public clients. It is the national version of the EU directive EN-16931, which specifies the use of the structured data format XML for electronic invoice exchange. In some cases, XRechnung is also referred to as e-invoicing. From January 1, 2025, e-invoicing will be mandatory.

The Federal Cabinet's Growth Opportunities Act will introduce a clear separation between electronic invoices and other forms such as paper receipts. Electronic invoices must be created in a structured format that complies with the European standard CEN EN 16931. This includes common formats such as ZUGFeRD and XRechnung, which have been specially developed to meet these standards. Paper documents that do not meet these requirements will no longer be legally compliant. It therefore makes sense to get to grips with these innovations at an early stage.

What is the difference between an XRechnung and a ZUGFeRD invoice?

A ZUGFeRD invoice, on the other hand, is a hybrid electronic invoice format (e-invoice) consisting of PDF and XML, which is particularly suitable for digital invoice processing between companies.

A ZUGFeRD invoice created by Billomat therefore also contains a valid XRechnung.

How do I create a ZUGFeRD invoice with Billomat?

Create a new invoice template

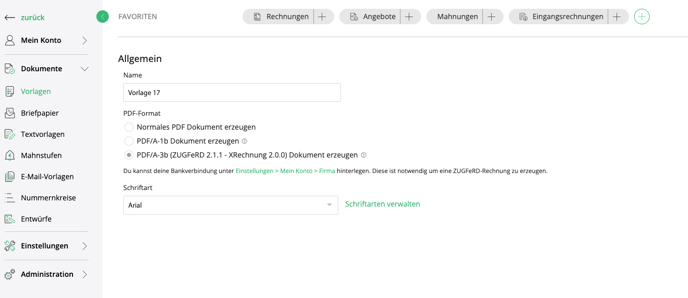

- To do this, navigate to Settings > Documents > Templates > Invoices > Create new template.

- Select the “Create PDF/A-3b (ZUGFeRD 2.1.1 - XRechnung 2.0.0) document” checkbox

- If you are using a background file, please make sure that it is in PDF/A format. If this is not the case, no xml file will be created!

- Make individual settings to your invoice template.

Note: You can only save the template once you have saved your bank details under Settings > My account > Company.

- Check the default settings:

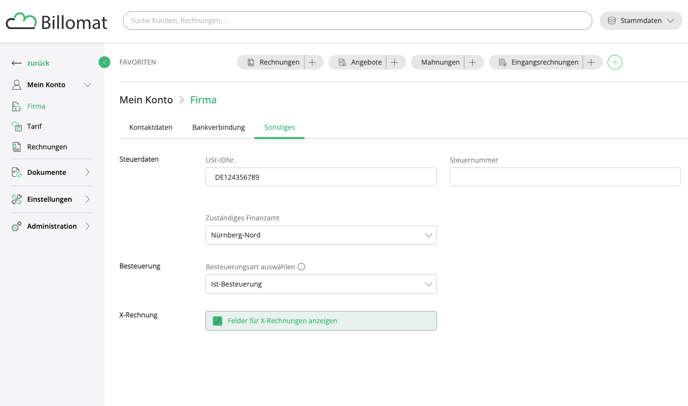

- It is important that your own VAT ID is shown in the company data with the prefix.

- Check the box “Show fields for X-invoices” in your settings under My account > Company > Other.

- If you send your invoices to an authority, do not forget to create the routing ID. To do this, search for your customer under Master data > Customers, navigate to Customer data > Routing ID and add it.

Create your ZUGFeRD invoice

- Create a new invoice under Invoices > New invoice, search for your customer and select your previously created invoice template in the invoice detail view on the right-hand side under Templates > Layout.

- If necessary, enter the order reference number in the field on the right in the sidebar:

- Complete the invoice and click on “Send”.

How do I create an X-invoice with Billomat?

Follow all the steps above to create a ZUGFeRD invoice.

Instead of the last point “Send”, follow these steps:

- Download the PDF document and open it with Adobe Acrobat Reader.

- Now click on the paperclip icon in the left toolbar.

- There you will find the extracted XML file, which you can open and save by right-clicking.

You can now send this extracted XML file as an attachment by e-mail or upload it directly to an online portal.

What are the technical differences?

The XML syntaxes for XInvoices can map the EU directive EN-16931 in UBL and CII format. UBL stands for Universal Business Language and CII for Cross Industry Invoice.

Billomat supports the ZUGFeRD invoice and therefore only the CII format for the XML. It is therefore currently not possible to create an XInvoice in UBL format